These experts are adept at crafting high-level letters of intent and diligently scour multiple public and private sources to uncover potential funding opportunities.

What Does a Grant Writer Do?

A grant writer plays an indispensable role in sourcing funds for organizations and projects. The essence of their job lies in understanding the objectives, needs, and goals of the organization they’re representing.

They translate this understanding into a coherent, structured proposal that highlights the significance and feasibility of the intended project or initiative. Their work involves research, collaboration with subject matter experts, and adhering to strict grant application guidelines.

Grant Writing Job Market

The government doesn’t collect labor statistics on grant writing. Although some of the anecdotal information they’ve put together says most current grant writers are self-employed. They charge hourly rates somewhere between $20 to $100 dollars for grant writer services.

Other information puts the job growth to 2030 at 9%. The median salary for this year for all grant writers was $49,554.

Popular industries that employ grant writers include government agencies and nonprofit organizations. Additionally, more specific places, such as community health centers, require ongoing funding as well.

Here’s an outline from the Bureau of Labor Statistics.

- READ MORE: how to get a small business grant

Benefits of a Career Writing Grant Proposals

A grant writing career can be rewarding. Maybe you’re looking at working with research grants and opportunities for nonprofits or small businesses. Becoming a grant writer has some great advantages.

Here’s a list of some of the things that you’ll enjoy about working at grant writing and coming up with grant proposals.

- You’ll Be in Demand – Many different industries are looking for grant writers. You might also be able to work for a nonprofit organization. Another specific industry that hires to write grants is government organizations. Snd technical writing, which includes grant writing, is expected to grow.

- You Can Be Your Own Boss – Grant writers generally set their own schedules. As sole proprietors, they can pick the clients they work with and set their own prices.

- You’ll Be Learning Something Everyday – You might be drafting proposals for a nonprofit organization, or you might be working at getting grants for small businesses. Regardless of the approach, you’ll be writing grants and learning something new every day. It’s a challenging and rewarding career. Grant writers interact with a wide range of people and organizations, as well as other grant writers, to make it more interesting.

- You’ll Make a Difference – Securing grants can help an organization’s mission. Grant writers help individuals and businesses get the cash they need for a cause.

- You’ll Make a Good Income – The average base salary for a grant writer in America is $56,251 a year. This of course depends on the organization you work for. If you freelance, you can make a different hourly rate and more money.

How to Become a Grant Writer

Do you want to write grants for a living? This is a good career path if you want to be self-employed. Along with strong organizational skills, you need to follow these steps to get started as a grant writer.

Get The Right Education

Employed grant writers typically hold degrees in communications or English, and an undergraduate degree in journalism can also be beneficial. This educational background can provide a competitive advantage and aid in the development of your writing skills.

Getting an education from a community college helps, too. A vocational diploma can help you land a first job doing volunteer work for public foundations.

Hone Your Grant Writing Skills

Writing a good grant proposal is a skill. Enroll in an online grant writing course. Best to look for one that will supply you with a grant writing certification. Here’s an overview of some of the options you have online.

Starting out with creative writing skills builds a foundation to get crucial funding for clients.

You might be able to skip getting a higher education by taking this route to become a grant writer. Either way, you’ll need to follow grant guidelines carefully.

Put A Portfolio Together

Establishing trust is a vital part of a grant writer’s career trajectory. A comprehensive portfolio acts as a testament to a grant writer’s skills, experience, and success rate.

Incorporating success stories, acknowledgment letters, and measurable outcomes can enhance the appeal of the portfolio.

For budding grant writers lacking in professional experience, volunteering not only provides an opportunity to build a portfolio but also demonstrates proactiveness, an understanding of the non-profit ecosystem, and a genuine commitment to community development.

Pick an Employment Model

Writers in this industry can work on a full-time, part-time, contract, or freelance basis. You can also be self-employed. If you decide to work at grant funding for yourself, you’ll need to decide how much to charge.

Grant Writer Employment Models

To better understand the diverse career opportunities in grant writing, here’s a comparison table of different employment models available for grant writers.

| Employment Model | Description | Pros | Cons |

|---|---|---|---|

| Full-Time | Working for a single organization or company on a regular basis. | Steady income; Benefits provided | Limited flexibility; Tied to one client |

| Part-Time | Working for an organization for a limited number of hours weekly. | More flexibility; Possible benefits | Less income; Possibly multiple clients |

| Contract | Working for a specific project or a set period. | Defined tenure; Specific projects | No long-term job security |

| Freelance | Self-employed and working for multiple clients. | High flexibility; Diverse projects | Inconsistent income; No benefits |

| Self-Employed | Owning a business providing grant writing services. | Total control; Business benefits | High responsibility; Business overheads |

Advertise

The digital age offers numerous platforms for grant writers to showcase their expertise and attract potential clients.

Beyond the traditional website, leveraging platforms like LinkedIn, Twitter, and even Instagram can help in networking with non-profit organizations, philanthropists, and other stakeholders.

By sharing insights, success stories, and testimonials, grant writers can underscore their expertise and stand out in a competitive market. Additionally, hosting webinars, workshops, or speaking at conferences can further establish their authority in the domain.

Fostering Strong Relationships

The role of a grant writer isn’t limited to penning down compelling proposals. They often act as the bridge between organizations and potential funders.

This requires impeccable interpersonal skills to foster positive relationships and facilitate effective communication.

Cultivating these relationships can lead to referrals, repeat business, and a reputation for being not just a writer but a strategic partner in an organization’s growth and success.

Small Business Opportunities for Grant Writers

Now you know how to become a grant writer. You’ve spent time researching grants and learning how to write a grant proposal. The next step is to work for someone or start your own business.

If you are an experienced grant writer, you can start a business. Here’s how.

Define the market. Maybe grant money for nonprofits? Maybe you’ll be securing funding for SMBs? Then, you need to research the sources for funding. Then, grant writers need to market their organization. See above.

Expanding Your Career as a Grant Writer

Grant writing is a nuanced field that blends art with science, requiring a unique set of skills, dedication, and an understanding of the funding landscape.

Whether you’re drafting proposals for non-profits, educational institutions, or small businesses, the role of a grant writer is both challenging and rewarding. Here’s how you can further your career and enhance your effectiveness as a grant writer.

Deepening Industry Knowledge

- Stay Informed: Regularly enhance your understanding of grant-making organizations, such as foundations, government agencies, and corporations. Being aware of their priorities, funding cycles, and application procedures can provide you with a competitive advantage when crafting successful proposals.

- Specialize: Consider specializing in a specific sector such as healthcare, education, or environmental conservation. Specialization can lead to deeper understanding and expertise, making your services more valuable.

Enhancing Proposal Quality

- Storytelling: Beyond just presenting facts and figures, effective grant proposals tell a compelling story. They connect the objectives of the project with the mission of the grant-making organization and illustrate the impact of the proposed work. Improve your storytelling skills to create more engaging and persuasive proposals.

- Data Analysis: Grant writers often need to include data and research in their proposals to support their claims. Developing skills in data analysis and interpretation can help you present a stronger case for your proposals.

Building a Network

- Collaborate: Building relationships with professionals in your field or sector can lead to collaborative grant writing opportunities. Collaboration can also provide new insights and approaches to grant writing.

- Join Professional Associations: Becoming a member of professional associations for grant writers or the non-profit sector can provide networking opportunities, professional development resources, and access to job postings.

Leveraging Technology

- Grant Management Software: Familiarize yourself with grant management and writing software. These tools can help streamline the research process, manage deadlines, and organize application materials, making you more efficient and effective.

- Online Presence: Enhance your online presence by sharing your successes and insights on professional platforms like LinkedIn. This can help you establish yourself as an expert in the field and attract new clients or employment opportunities.

Continuous Learning and Development

- Professional Development: Participate in workshops, webinars, and conferences focused on grant writing and your areas of expertise. Ongoing education can keep you informed about best practices and new trends in the field.

- Certifications: Consider obtaining professional certifications in grant writing. These can validate your skills and knowledge, making you more attractive to employers and clients.

Conclusion: The Path Ahead for Grant Writers

As the demand for skilled grant writers continues to grow, there are ample opportunities for professionals in this field to advance their careers.

By deepening your industry knowledge, enhancing your proposal writing skills, building a strong professional network, leveraging technology, and committing to continuous learning and development, you can increase your value and effectiveness as a grant writer.

Whether you choose to work as a freelancer, for a non-profit, or in the public sector, your contributions can lead to significant social impact, funding for vital projects, and the achievement of organizational goals.

Embrace the challenges and rewards that come with being a grant writer, and continue to make a difference in the world through your words and dedication.

What Skills Are Needed for Grant Writing?

The grant writing process requires certain talents, like the following.

- It is important to recognize the impact that data entry can have on a grant application. The application process should incorporate both historical data and projections for the future.

- A typical day will make the most of your writing skills. You’ll need to use business language and emotional words and phrases.

- This is project-based work. That means you need to be both process and detail-orientated.

How Much Money Do Grant Writers Make?

You’ll be in line to make a decent amount using your grant writing services. The average base salary according to Indeed is $56,297 dollars per year.

At the top end, successful grant writers working for places like Friends of the Children make $88,478 yearly. Other organizations like BRAZOSPORT COLLEGE pay $69,021 per year.

You can make more by honing your skills to attract more potential donors. And add to your profits by working for more than one organization as a freelancer.

READ MORE:

- how to get a small business grant

- How to Write a Grant: Your Ultimate Guide

- Where to Find a Grant Writer

Image: Envato Elements

This article, "What is a Grant Writer?" was first published on Small Business Trends

]]>

Obtaining government grants for your small business is certainly achievable. Nevertheless, the process is quite competitive.

Federal government grants serve numerous purposes. These government grants can assist you in growing your business and boosting your profits. If you’re in search of where to get free money to start a small business, that represents a separate area of interest. Additionally, there are various other grant programs available for small businesses.

We’re going to talk about United States government grants.

What Are Government Grants?

Federal government grants for small businesses are like a financial aid program. What’s different is that the monetary awards are not loans that you have to repay. You go through an application process (we’ll tell you how below), and if successful, you’ll be awarded a government grant and receive funding.

In what ways can you use a grant? The federal government grants are designed to fund projects and ideas that provide public services, such as critical recovery initiatives, and stimulate the economy.

Who Qualifies for Federal Government Grants?

There are a number of entities that can qualify for a government grant. Small businesses have to meet certain standards according to their size (number of employees) and average annual receipts.

Nonprofit organizations are also eligible for financial assistance in the form of government grants. A nonprofit organization such as a research institution may see financial support funding opportunities for training programs, scientific research, and/or innovative research.

But there isn’t a one-size-fits-all definition for eligible small businesses. Each type of small business entity has a different standard. For example, an accounting firm and an agricultural business may qualify with widely different standards for the number of employees.

The Small Business Administration provides valuable information regarding small business qualifications for grant programs. While the SBA is often recognized primarily for its small business loans, it can also assist you in applying for government grants.

Why Should You Apply for United States Government Grants

Truly, there isn’t a reason why you shouldn’t apply.

- Free money – Yes, while it’s true there’s no such thing as free money, it’s free money for small businesses as long as you follow the guidelines for using the grant money and properly complete all the required tasks and paperwork. You don’t have to repay the grant money.

- Funding opportunities – If you’ve got projects or planned expansions that you can never quite afford, and you don’t want to take out loans, you may find funding opportunities via grant programs from federal agencies. And again, these aren’t loans that you have to repay.

- The application process can be done online, using gov websites for your grant application.

- The strict eligibility requirements for some grants may benefit specific small businesses. For example, some grants are available for women, minorities, or Veteran-owned businesses.

- You can search the government offers for grants using secure websites. You can surf those official websites on your own time.

- Searching for grants is free. You’ll be safely connected to the government website, with your sensitive information protected.

- Each grant period has a start and end date. Once you’ve registered and gone through the application process, it’s easier to complete any future grant application you make.

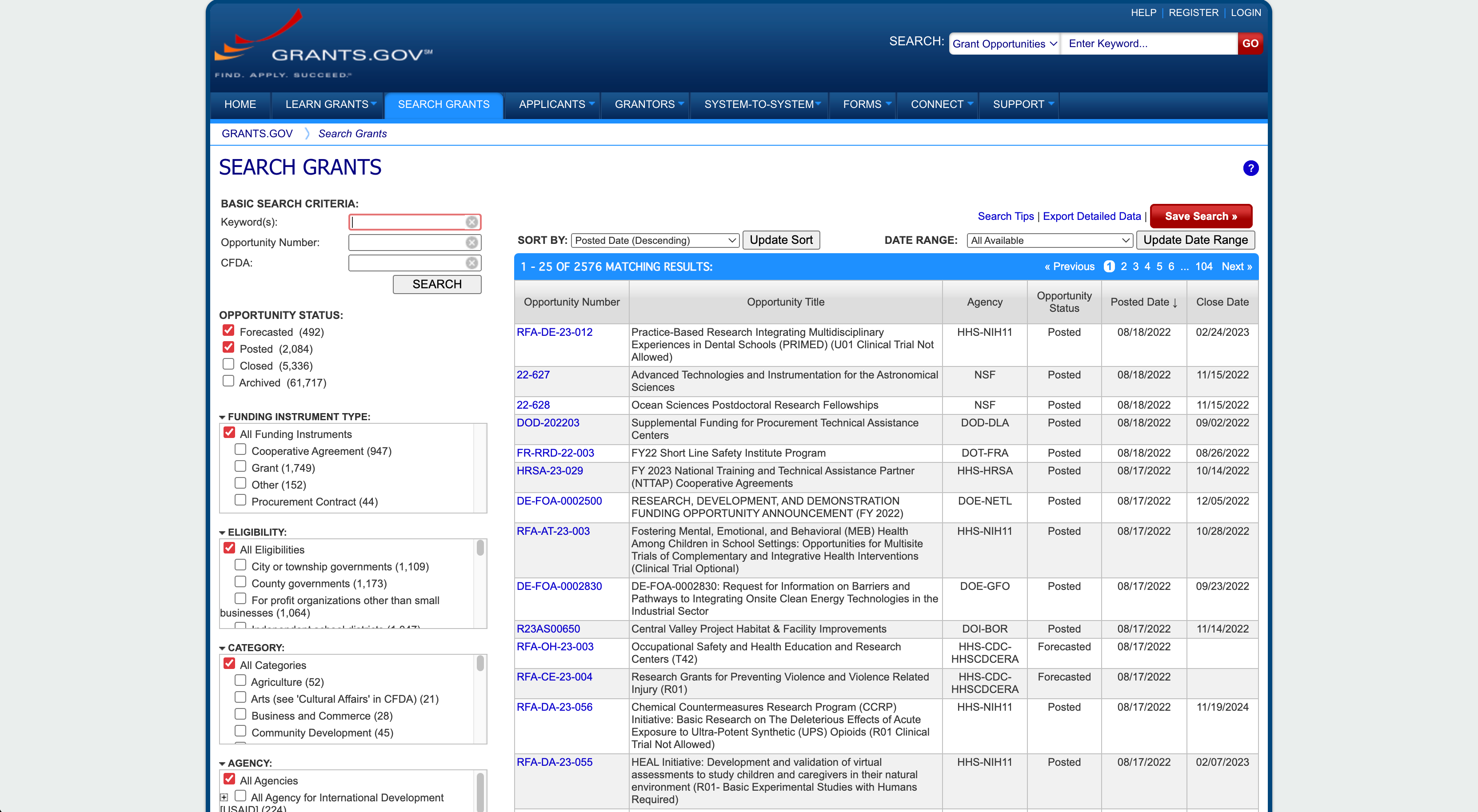

What Is Grants.Gov?

Grants. gov is the official government organization that compiles all the grant programs and initiates the funding if your business is awarded grants.

Grants.gov is a government agency that maintains information about federal government grants that are available to small businesses which qualify. All applicants for federal grants, such as small businesses, nonprofit organizations, and educational institutions start with Grants. gov.

That’s where you’ll start your grant funding application process and find out if you’re eligible according to your business size and other requirements.

How to Get Small Business Grant Programs with Grants.Gov

How can you get government grant funding opportunities? It’s a step-by-step process to submit your grant application. If, at some point in the grant process, you need technical assistance, that is just a few clicks away.

There are three main phases in applying for grants. Within each phase of the grant process, there may be certain tasks you’ll need to complete:

Phase 1: Pre-award

UEI

In order to get in line for grants, you’ll need to register with your contact information and get a Unique Entity Identifier (UEI) number. Just go to Grants. gov and click on the Register tab.

Congressional District Code

When completing your grant application, make sure to have your congressional district code ready. You should locate this information in advance so that you can easily enter it when required.

Search Grants

Search through the variety of grants that are available and make sure you are eligible as you apply.

Subscribe

Applicants should subscribe to get Alerts and Communications, which will keep you informed as new grants become available resources.

Submit

The final step in the Pre-award phase is for applicants to submit the grant application for funds.

Phase 2: Award

Federal government staff members review your application for a grant. After you submit the application, you may wait several months to learn whether or not you got the government grant.

The federal government staff will review the eligibility requirements to make sure business applicants qualify for government grant funds. They will also review your proposal for funding and review your financial information, including whether or not you have outstanding business loans.

Notification of Award

If your government grant application is approved, your business will receive a NOA or Notification of Award for a government grant.

Phase 3: Post Award

Once your eligibility and grant application have been approved, you’ll receive the government funding for your projects. That doesn’t mean the need for paperwork has ended.

Government grants have specific requirements to keep tabs on accountability. As part of being awarded grants, a business will most likely be required to make performance progress reports at specified times.

Government grants have specific start and end dates. For example, government offers of funds may specify that the funds be spent within 3 months. Or funding may be spread out over a longer period, even a year or several years.

During this period, a business is required to maintain detailed records of the expenditures made with government money. Within 90 days following the conclusion of the government grant period, you must complete the funding Reporting and Closeout Requirements.

Types of Government Grant

Government money is available for many types of entities, including universities and various nonprofit organizations.

Here are the basic types of entities that qualify for government funding opportunities:

- State and Local government – State and local government agencies can get funding for a community program or a project designed to stimulate the community economy. They can use government monies to improve community education resources, such as adult education or language programs.

- Education – Universities, and institutions – These education organizations can get government funding for a program needed for both students and educators. For example, a science department may seek a grant for the development of new research techniques. Or a technical college may seek a grant for the development of a new training program, such as a truck driver school or aeronautic mechanics.

- Research Laboratories – A research laboratory might pursue funding for a vaccine research initiative or seek financial support to enhance educational opportunities for lab technicians.

- Law Enforcement Organizations – The most common government grants for these agencies are projects that improve community safety services, such as establishing neighborhood watches for interested community members.

- Non-profit Organizations – Government money is available for nonprofits who want to expand the services they provide for a community.

- Small businesses – Your access to government grant money is not blocked by a locked padlock. You have the key!

Image: Depositphotos

This article, "How to Get Government Grants Using Grants.Gov" was first published on Small Business Trends

]]>Grants are essential for providing financial assistance and funding research and development, playing a crucial role in the establishment and growth of businesses. Among the various forms of financial support, subsidies and grants are particularly noteworthy for their benefits.

What is a Grant, and How Does it Work?

In simple terms, what is a grant? A grant is financial assistance provided to individuals, businesses, or corporations by federal, state, and local governments, as well as nonprofits and private companies. Grants are a key option for small business funding.

Because they do not require repayment of any kind making them an attractive financial consideration for entrepreneurs and small businesses for start-up, growth, or expansion.

Usually, a grant becomes available when a government agency, nonprofit or private business chooses to set aside grant money for an area of concern of their choice.

This could be to encourage minority entrepreneurship in a community, stimulate small businesses in communities, or reward innovation. Once the opportunity is created, applications are made, award decisions are made, and the money is allocated.

The Strategic Value of Grants

Beyond the immediate financial relief, grants carry strategic value for recipients. They enable organizations to undertake projects that might have been out of reach due to budget constraints, thereby fostering innovation and allowing for the exploration of new ventures.

- Innovation and Research: Grants often fund projects that push the boundaries of technology, medicine, and social services, contributing to societal progress and the advancement of knowledge.

- Community Impact: Many grants focus on projects that have a direct positive impact on communities, such as improving public health, education, and environmental sustainability.

- Economic Development: Grants are essential for economic development as they support small businesses and non-profits, leading to job creation and improved quality of life in diverse communities.

Reasons to Get a Small Business Grant

Navigating the waters of business ownership can be challenging, and finding ways to fund your venture is a pivotal aspect of success. One such avenue that often goes unnoticed or underutilized is the potential of small business grants.

These grants can act as a crucial resource for both startups and established businesses, offering financial assistance for a range of needs. Let’s explore the key reasons why securing a small business grant can be transformative:

It’s Free Money (Sort Of)

When we talk about business grants, we’re referring to a financial windfall that doesn’t come with the strings of debt. Unlike traditional loans that accumulate interest and require repayment, grants offer “free money” to fuel your business aspirations.

However, it’s essential to remember that this money is allocated for specific purposes. These stipulations ensure that funds are used productively, aligning with both the business’s needs and the grant’s intentions.

You Need Working Capital

Every business, whether a fledgling startup or an established company, understands the value of working capital. It’s the financial lubricant that ensures seamless daily operations.

Whether you’re looking to pay staff, replenish inventory, or invest in marketing, a healthy working capital is essential. Here’s where business grants can play a pivotal role.

They can offer that much-needed boost, allowing businesses to reinforce their operational foundation, adapt to new technologies, and even expand into franchising.

Buying more assets

Scaling up is an inevitable aspect of business growth. Maybe it’s the cutting-edge machinery that promises more efficient production, or perhaps it’s the addition of vehicles to boost delivery capabilities.

Whatever the asset, its acquisition often comes with substantial costs. While these investments promise significant returns in the long run, their immediate financial impact can be burdensome.

Grants offer an opportunity to bridge this funding gap, ensuring businesses can grow without straining their resources.

Starting a business

The entrepreneurial dream can sometimes be stalled by the harsh reality of startup costs. From renting a space and hiring staff to investing in initial inventory and marketing, the financial demands can be overwhelming.

This is where a business grant can come to the rescue. For many budding entrepreneurs, a grant can mean the difference between shelving their startup dream and turning it into a tangible reality.

It offers a financial cushion that can help navigate the initial turbulence of business setup.

To Expand Your Market

Venturing into new markets, particularly international ones, holds the promise of exponential growth. But this expansion is not without its challenges. It demands significant financial outlay and strategic resources.

Some business grants will let you expand into new markets. For example, the Small Business Administration’s (SBA) State Trade Expansion Program (STEP) provides financial awards to assist small businesses with export development.

Besides helping you enter international markets; through the grant program you get to participate in foreign trade missions; help you in marketing your products internationally; gain support with e-commerce capabilities and more.

Reasons to Get a Small Business Grant

- It’s Free Money

- You Need Working Capital

- Buying More Assets

- Starting A Business

- To Expand Your Market

- READ MORE: Types of Grants

Different Grants for Businesses

As a small business owner, you have different grants available to you to fund your business projects, such as incubators, accelerators, or loan programs. Below are some grants available for small businesses and startups:

| Type of Grant | Key Features | Best For |

|---|---|---|

| Federal Grants | High competition, need to adhere to funding requirements | Startups, growth businesses |

| State Grants | Supports job creation and local economy | Businesses within specific states |

| Local Government Grants | Less competitive, focused on community improvement | Community-oriented businesses |

| SBA Grants | Offers a variety, includes pandemic relief | Diverse range of small businesses |

| Corporation Grants | Offered by large companies, merit-based | Startups, expansion projects |

| Diversity Grants | Promote diversity, easier application process | Minority-owned businesses |

| Nonprofit Organizations | Forward a specific cause, specific use requirements | Eco-friendly businesses, research and development |

Federal Grants

Federal government grants for small businesses offer funding to help launch or grow small businesses.

Usually, Federal domestic assistance grants offer the most money and come with a lot of competition this is because there is no need for eligible grantees to pay the funds back so long as the grant is spent following the funding requirements.

Make sure that your application for a government grant is well-researched and clearly articulated. You can access a database for federal grants at Grants.gov.

State Grants

Each state understands the importance of small businesses in driving the economy forward. By fostering the growth of these entities, they can generate more job opportunities and enhance the overall economic health of the region.

State grants are financial instruments tailor-made for this purpose. They act as a financial booster to stimulate growth while simultaneously ensuring that the state’s unique objectives and priorities are met.

These grants are carefully curated to address specific needs and challenges faced by businesses within the state’s territory.

If you’re a small business owner keen on leveraging this opportunity, start by exploring the official webpage of your state. This platform will provide insights into various grant programs that align with your business requirements and aspirations.

Local Government Grants

At the grassroots level, local governments play a pivotal role in nurturing and empowering small businesses. The beauty of local government grants is their specificity; they are curated to address the nuanced needs of the community.

As these grants are more localized, the competition is typically less fierce, offering a higher success rate for applicants. Moreover, these grants have a dual purpose. Not only do they fuel the growth of small businesses, but they also aim at bringing about tangible improvements within the local community.

If your business aims to create a positive impact in your community—whether through community services, local job creation, or other initiatives that enhance communal well-being—local grants can be incredibly valuable.

Research the offerings of your local government, and you might stumble upon a grant that’s a perfect fit for your business model.

SBA Grants

The Small Business Administration (SBA) is an independent federal agency set up to promote entrepreneurship and protect the interests of small businesses.

It offers a range of grants for small businesses, minority-owned businesses, veteran-owned businesses, eligible community organizations, and others.

Some of its grants focus on research and development, while others aim to support small businesses in becoming more resilient.

The SBA has even provided pandemic relief to small businesses that were impacted by the pandemic through programs that include the Paycheck Protection Program (PPP), COVID Economic Injury Disaster Loan (EIDL), SBA Express Bridge Loans, and others. To access available grants go to the SBA’s grants page.

Corporation Grants

Government agencies aren’t the only source of small-business grants; corporations and large companies, too, offer small-business grants through their philanthropic schemes.

Many private corporations and non-profit organizations also offer private grant programs designed to help small business owners start and expand their businesses.

While some of them provide grants to nonprofits servicing specific industries only while others give to for-profit companies. These grants are given based on merit and application materials, like essays, testimonials, or proposals.

Some corporate grants to look into include FedEx Small Business Grant Contest, Visa Everywhere Initiative, and Amazon’s Black Business Accelerator Program.

Diversity Grants

Diversity grant programs are designed to eliminate bias or promote diversity by offering financial assistance. These grants provide funding to assist small businesses owned by women, minorities, those with disabilities, and age in a bid.

They often come with an application process that is easier to navigate and also offer some kind of technical assistance as well.

If you are a minority-owned small business, you can access some grant opportunities at the National Association for the Self-Employed (NASE), WomensNet Amber Grant, and The Coalition to Back Black Businesses.

Nonprofit Organizations

Driven by a mission rather than profit, nonprofit organizations often allocate resources to advance causes close to their heart.

These grants, while generous, usually come with well-defined parameters to ensure the funds are used in alignment with the organization’s core values and objectives. The grants can serve a myriad of purposes:

- Local Job Creation: Recognizing the ripple effect of employment on the community’s well-being, some nonprofits grant funds to businesses that show promise in generating local jobs. By doing so, they aim to reduce unemployment and spur economic growth.

- Research and Development: The world thrives on innovation, and nonprofits play a significant role in this. Grants could be directed towards businesses that focus on R&D, fostering breakthroughs in fields like medicine, technology, or sustainable practices.

- Supporting Minorities: Equality is foundational to many nonprofit missions. To level the playing field, these organizations often provide grants to minority-owned businesses or those that serve underserved communities, ensuring they get the same opportunities as their counterparts.

- Eco-friendly Initiatives: As global attention shifts towards sustainability, nonprofits are at the forefront of promoting green business practices. Grants in this sector help businesses adopt or develop eco-friendly technologies, sustainable products, or practices that significantly reduce their carbon footprint.

When considering a grant from a nonprofit, it’s essential to thoroughly understand the stipulated requirements and ensure that your business objectives align seamlessly with the grant’s intended purpose.

This not only increases the likelihood of securing the grant but also ensures a harmonious relationship with the grantor as you work towards mutual goals.

- READ MORE: Do Grants Have to be Paid Back

Navigating the Grant Application Process

The process of applying for a grant can be intimidating; however, grasping its intricacies can greatly enhance your likelihood of success.

- Research and Preparation: Thorough research is crucial to identify grants that align with your organization’s mission and projects. Preparation involves understanding the grant’s objectives, eligibility criteria, and application requirements.

- Crafting a Compelling Proposal: A successful grant proposal clearly articulates the problem your project aims to solve, the proposed solution, and the expected outcomes. It should also demonstrate your organization’s capacity to successfully execute the project.

- Follow-up and Reporting: Once a grant is awarded, maintaining open lines of communication with the grantor and adhering to reporting requirements is essential. This not only ensures compliance but also builds trust and credibility for future funding opportunities.

- READ MORE: How to Get a Small Business Grant

Leveraging Grants for Sustainable Growth

Grants should not be viewed as one-off financial windfalls but as part of a strategic approach to sustainable growth. This perspective involves planning how a grant can be used not just for immediate needs but also to lay the groundwork for future projects and funding opportunities.

- Strategic Planning: Incorporate grants into your broader financial and operational planning. Consider how a grant can help achieve long-term goals and address strategic priorities.

- Capacity Building: Use grants to build your organization’s capacity, such as investing in staff training, technology upgrades, or process improvements. This enhances your ability to deliver on current projects and positions you for future success.

- Community and Stakeholder Engagement: Engage with your community and stakeholders about the projects funded by grants. This not only builds support but also demonstrates the tangible benefits of your work, strengthening your case for future funding.

Maximizing the Potential of Grants

Grants offer more than just financial support; they provide a foundation for innovation, community development, and economic growth. By understanding the strategic value of grants, navigating the application process effectively, and leveraging funding for sustainable growth, organizations can maximize the potential of grants.

Whether you’re a startup, a non-profit, or a small business looking to expand, grants offer a pathway to achieving your goals while making a positive impact on society.

As the grant landscape continues to evolve, staying informed and engaged will be key to unlocking the transformative power of grants.

Is a Business Grant Worth It for Small Businesses?

Yes, a business grant can help offer that extra financial assistance to get your business up or running or humming. What’s great about a business grant is that they do not need to be repaid. This comes in handy for businesses that may have financing difficulties and face challenges in repaying traditional business loans.

In addition, business grants are relatively easy to find online and can sometimes come with additional resources, such as training and technical support, that can improve your business’ effectiveness.

Where to Find Small Business Grant Programs

There are various tiers of business grants available from the federal level to the local or county government level. Most of them are available online such as through Grants.gov, SBA’s grants page, or your local chamber of commerce’s website.

READ MORE:

- How to Get a Small Business Grant

- Types of Grants

- Do Grants Have to be Paid Back

- What Grants do I Qualify for

Image: Depositphotos

This article, "What is a Grant?" was first published on Small Business Trends

]]>

There are many different types of grants available depending on what you are looking for. A grant program can help provide funding for your business, research, or education. In this article, we’ll go over a list of the top 20 types of grants available for your organization today.

What are Business Grants and How Do They Work?

A business grant is a financial award given to a business to help it grow, expand, or simply get started. They are broadly categorized as being government and private, with government grants being more numerous but also more difficult to obtain.

The grant application process can be lengthy, but it’s worth it, as most grants don’t need to be repaid. Additionally, there are typically no minimum requirements in terms of credit score or financial history, and applying for grants won’t affect your FICO score.

- READ MORE: How to Get Free Grants for Small Business

What are The 4 Main Types of Business Grants?

Business owners are always looking for funding. There are many grant types available that provide businesses with the funds they need, such as the following:

- Federal Grants. Businesses can get federal government grants from the United States government. The government offers these types of grants to promote new businesses and jobs, support research and development, and help businesses expand into new markets.

- State Grants. These are grants offered by state governments to businesses operating within their state. The requirements and amount of funding available vary by state, but these types of grants are typically available to help businesses with start-up costs, job creation, and expansion.

- Local Grants. Local governments provide grants to businesses, usually as tax breaks or low-interest loans. These types of grants are generally accessible to businesses that are creating new jobs or making investments in the community.

- Corporate Grants. Some large corporations offer grants to small businesses. These types of grants are typically available to businesses that are aligned with the corporation’s goals, such as promoting diversity or environmental sustainability.

Different Grant Programs

Government funding sources and grant opportunities are accessible to all eligible entities and businesses, regardless of size, from federal, state, and local governments, as well as non-federal organizations. However, the eligibility criteria and application processes can differ significantly between programs. Let’s explore our list to find the grant that suits your needs:

Federal Government Grant Funding

The federal government offers a variety of grant programs for businesses. Federal grants are available from several different federal agencies, including the Department of Commerce, the Department of Energy, and the Small Business Administration.

- READ MORE: Small Business Administration Grants

Grant funds from federal agencies can be used for a wide variety of purposes, including research and development, marketing, and workforce training. Let’s take a look at some:

SBIR and STTR

If you’re looking to fund and establish a new program but need financial support in the form of a planning grant for initial research efforts, then the SBIR and STTR projects may be for you. However, you’ll need to justify the need for the program you’re trying to establish when applying.

Trade Adjustment Assistance For Firms

The Trade Adjustment Assistance for Firms program provides financial assistance to businesses that have been negatively affected by imports. The funding can be used for a variety of purposes, including plant renovations, marketing, and training.

MBDA

The MBDA program provides financial and technical assistance to minority-owned businesses. The program is designed to help businesses grow and create jobs.

SUD Startup Challenge

The SUD Startup Challenge is a grant that provides funding to businesses that are working on solutions to the nation’s opioid crisis. The goal of the program is to encourage entrepreneurship and innovation in the fight against addiction.

Rural Energy for America Program

The Rural Energy for America Program offers financial support to businesses and farmers engaged in projects aimed at lowering energy consumption. This funding can be utilized for several purposes, such as upgrading energy efficiency, implementing renewable energy initiatives, and conducting feasibility studies.

Pass-Through Grants

Pass-through grants enable organizations to obtain funding directly from the granting body, eliminating the need for an intermediary. This funding structure is advantageous as it helps organizations avoid bureaucratic hurdles and facilitates a quicker receipt of funds.

Natural Resource Sales Assistance programs

The Natural Resource Sales Assistance program provides funding to businesses that are working on projects to develop natural resources, such as timber, minerals, and oil and gas. The funding can be used for a variety of purposes, including feasibility studies, project planning, and marketing.

State and Local Grant Programs

State and local governments provide funding for businesses through various types of grants. Here is a couple:

Formula Grants

These grants are non-competitive. Formula grants are available from the federal, state, and local government levels and are given to pre-determined recipients. All applicants who have an interest in these grants will need to meet the minimum census criteria to qualify. When applying, read over the funding announcement to know the type of grant you’re applying for so you can proceed accordingly. The Nutrition Services Incentive Program is an example of such a grant.

Research Grants

When seeking grant funding from local governments, it’s important to be aware of the overhead expenses that are typically associated with these grants. Many health-related research projects may have a difficult time securing funding because of their high overhead costs.

Non-Federal Entities

There are numerous programs available from non-federal entities that offer grant funds to businesses. These programs deliver financial support and assistance for various business requirements, ranging from start-ups to expansions. Below, we will explore some of these types of grants:

Nav Business Grant Contest

The Nav Business Grant Contest is a great opportunity for small businesses. The quarterly contest offers a $10,000 grand prize and a $5,000 runner-up prize.

Visa Everywhere Initiative

The Visa Everywhere Initiative is a global grant program that was first launched in the U.S. in 2015. To date, 8,500 startups have participated in the program and have collectively raised more than $16 billion in grant funding. The Visa Everywhere Initiative offers prizes worth over $500,000, with the overall winner receiving $100,000.

Idea Cafe Small Business Grant Funding

If you are a woman entrepreneur who wants to start a business or already owns one, the Idea Cafe Small Business Grant Funding could be for you. Grants of $1,000 are available, with three finalists each receiving a $500 advertising credit.

National Association for the Self-Employed (NASE) growth grants

The National Association for the Self-Employed (NASE) is a nonprofit that offers growth grants to its members. These grants can be up to $4,000, and applications are reviewed quarterly based on the schedule on the NASE website. To be eligible for a grant, members must be in good standing. The NASE has awarded nearly $1,000,000 in grants since 2006.

FedEx Support Small Business Grant Contest

The FedEx Support Small Business Grant Contest has been running since 2012. It is open to for-profit small businesses that have been selling a product for at least six months by the time the contest starts and has 99 employees or less. The businesses must also have a shipping need to qualify for the grant.

Queer to Stay Initiative

The Queer to Stay Initiative is a grant program established by The Human Rights Campaign and SHOWTIME® to offer financial assistance to small businesses catering to the LGBTQ+ community. This initiative aims to support at least 25 businesses, helping them to sustain their services for the LGBTQ+ community.

SoGal Black Founder Startup Grant

SoGal, a social media company geared towards millennial women of color, is offering $10,000 and $5,000 cash grants to black women entrepreneurs. The grant requires the recipient to seek investor financing to scale their business.

Patagonia Corporate Grant

The Patagonia Corporate Grant provides financial support to environmental organizations. The grant size typically ranges between $5,000 and $20,000, depending on the grant program you apply to.

- READ MORE: The Latest Grants for the Self-Employed

Nonprofit Organizations

There are many grant programs available to help a nonprofit organization with financial management and overhead expenses. For example, the following three grants round out our list:

Seed Money Grant Programs

Seed money grant programs allow nonprofit organizations to receive funding. The start-up grant funding can be used for a variety of purposes, such as marketing, research and development, or hiring new employees. Eligibility requirements vary depending on the program.

Facilities and Equipment Grant programs

These funding sources provide financial assistance to a nonprofit organization for the construction, renovation, or purchase of facilities and equipment. These grants can be used to cover a wide range of costs, including the purchase of new equipment, renovation of existing facilities, or the construction of new facilities.

Technical Assistance Grants

Technical assistance grants provide financial assistance to a nonprofit organization for the purpose of providing technical assistance to the organization. These grants can be used to cover the costs of hiring consultants, providing training to staff, or developing new programs.

How to Find Small Business Grant Funding

When it comes to finding small business grant funding, it’s important to do your research on a site like Grants.gov or the Catalog of Federal Domestic Assistance (CFDA). You can easily filter for small business grants and other criteria on Grants.gov.

Start by looking for research grants, as these are often available to new applicants. Once you’ve found a few promising opportunities, submit a strong proposal.

It’s important to demonstrate your organization’s need and ability to use the funds effectively during the proposal selection process.

What is a General-Purpose Grant?

A general-purpose grant provides funding for a wide range of activities, such as research and development, marketing, or workforce training. These types of grants are typically available to businesses that are new or have limited experience in the activity being funded.

What is a Continuation Grant?

A continuation grant is a grant that is awarded to existing grantees or current award recipients. It provides funding for work that is already underway or has been previously funded.

Can a Competitive Grant be Used for Business?

Yes, a competitive grant can be used for business purposes. Most grants are written with a compelling narrative that explains how the requested funds will be used. The requested materials, such as the project budget and timeline, are important to demonstrate that your proposal is feasible.

Funds can often be used for educational and school programs. Schools and other educational institutions rely heavily on grant writing to secure the necessary resources for their various programs.

What is a currently funded entity?

A currently funded entity is a health-related organization that currently has guarantees of financial support from the government. This includes organizations such as hospitals, clinics, and other health-related facilities. The purpose of this financial support is to ensure that these organizations can continue providing essential services to the public.

Are federal grants hard to get?

The competition for federal grant funds can be fierce. It’s important to remember that federal grant programs are highly competitive and that the application process can be lengthy. The best way to increase your chances of success is to start the process early and put together a strong proposal.

READ MORE:

Image: Envato Elements

This article, "A Guide to Different Types of Grants and How to Apply" was first published on Small Business Trends

]]>

Writing a grant can be daunting! But with this guide, you’ll be on your way to improving your grant writing skills and securing the funding you need for your business or nonprofit organization.

We’ll walk through the basics of writing a proposal, such as what to include. So read on to discover everything grant writers need to know about writing a grant proposal!

What Is a Grant Proposal?

A grant proposal is a document submitted to federal government agencies to obtain funding for a proposed project. If you want to learn how to write a grant, understanding the components of an effective proposal is essential.

Grants are often highly competitive, and only the most well-constructed and persuasive proposals tend to succeed. Therefore, it is crucial to invest considerable effort into learning how to write a grant and creating a robust proposal.

Looking over previously funded grant applications that have received grant awards from funding agencies can give you a good idea of what reviewers are looking for.

Common Elements of Proposals to Get Grant Funding

To enhance your likelihood of obtaining grant funding, it’s essential to understand the key components of an effective grant proposal. Here are five crucial elements for crafting successful grant proposals:

- Statement of need: In your cover letter, you should include a summary of your project proposal along with an explanation of why it merits funding.

- Detailed project description: Provide comprehensive details in your project narrative to give reviewers a clearer understanding of your project beyond the brief overview included in your cover letter’s project description.

- Comprehensive implementation plan: Provide a clear and detailed outline of how you will execute your project.

- Evaluation component: Describe how you will evaluate the success of your project.

- Budget: Include a budget that outlines the estimated costs of your project.

Remember Your Grant Proposal Audience and Purpose

When writing effective grant proposals, remember your audience and purpose. First, identify the decision-makers – those who have the power to approve or reject your request. Then, think about what they care about and what their priorities are.

What needs does your project address? What are the benefits of funding your proposal? Keep those things in mind before you start writing your proposal to prospective grants, and you will be more likely to get the funding you need.

- READ MORE: How to Get a Small Business Grant

How to Write Grant Proposals

Writing grant proposals is a crucial part of the grant writing process. To create a successful grant proposal, you need to adhere to six essential steps:

Identify Funding Source

First, you’ll need to do your own research to identify potential funding agency sources for available grant programs. You can find funding sources by searching online databases or contacting the grant-making organization directly.

Funding Source Research

Next, you need to thoroughly research the funding source for your particular grant before beginning the grant application process to make sure that your project aligns with the organization’s mission and goals.

Develop a Proposal

Once you have identified a potential funding source, you need to develop an entire proposal that is clear and concise. Successful grant applications include a project overview, goals and objectives, and a detailed budget.

Submit Your Proposal

After your proposal is complete, you need to submit it to the funding source. This is usually done through an online portal or by mail.

Review and Revision

After you submit your proposal, the funding source will review it and offer feedback. If any revisions are required, be sure to address all comments and resubmit your proposal.

Award Notification

If your proposal is selected for funding, you will be notified by the funding source. If you’re not successful in securing funding, don’t be discouraged! Identify where your proposal went wrong to increase your odds of success with future proposals.

- READ MORE: Types of Grants

General Tips for How to Write Grants

Grant applications can be very competitive, so it’s important to put your best foot forward. Here are five tips and best practices for writing successful proposals:

- Start early: Don’t wait until the last minute to start writing your proposal. Give yourself plenty of time to develop a well-written and convincing proposal. Doing it last minute will only increase your chances of making mistakes.

- Follow the instructions: Make sure to follow all of the instructions provided by the funding source. If you don’t, your proposal may not even be considered. Spend some time reading through the instructions carefully to make sure you understand them.

- Edit and proofread: Before you submit your proposal, make sure to edit and proofread it for any grammar or spelling errors. Having a well-written proposal will make a good impression on the grant reviewers and increase your chances of being selected for funding.

- Get feedback: Ask a colleague or friend to read your proposal and provide feedback. Take their comments and suggestions into consideration before you submit your final proposal.

- Be persistent: If your proposal is not selected for funding, don’t give up. Keep trying and learn from your mistakes. Being persistent will only increase the likelihood that you’ll be successful the next time around.

How Long Should a Grant Proposal Be?

There is no fixed length for a proposal; however, most typically range from five to 20 pages. The length of your proposal will be influenced by the specific requirements of the funding source as well as the complexity of your project.

Regardless of length, all grant proposals should be clear, concise, and easy to understand.

- READ MORE: Where to Find a Grant Writer

What Information Do You Need to Write a Grant?

In order to write a grant proposal, you will need some basic information about your project. This includes your project overview, goals and objectives, and a detailed budget.

You will also need to know the guidelines of the funding source you are applying to in order to make sure that your proposal meets all of the requirements.

Is Grant Writing Difficult?

Grant writing can be a complicated and time-consuming endeavor, but it is certainly achievable with dedication and research. If you lack confidence in your grant writing skills, you might consider hiring a professional grant writer. Engaging an expert in grant writing can significantly enhance your chances of securing funding for your project.

How Do You Start Grant Writing?

The best way to start grant writing is to thoroughly research the funding source you’re interested in and make sure that your project aligns with its mission and goals.

Once you’ve done that, you can start developing a clear and concise proposal. Remember to edit and proofread your proposal before submitting it to the funding source.

READ MORE:

- How to Get a Small Business Grant

- Types of Grants

- Where to Find a Grant Writer

- What is a Grant Writer

Image: Envato Elements

This article, "How to Write a Grant" was first published on Small Business Trends

]]>Michigan Works! West Central is now accepting applications for its Going PRO Talent Fund, offering local businesses the opportunity to reimburse training costs for employees. The application window for the semi-annual funding cycle opened recently, with a deadline set for October 18 at 5 p.m., according to a report from BigRapidsNews.com.

Businesses can apply for up to $2,000 in reimbursement per employee and up to $3,500 for each U.S. Department of Labor (USDOL)-registered apprentice during this fall’s application period. A total of $45 million is available in Cycle 1 of the fall grant round, aiming to bolster employee retention and strengthen the local economy.

Since its inception in 2014, Michigan Works! West Central has helped secure over $4.9 million in training funds for 62 local employers, benefiting more than 5,600 workers, including 184 USDOL-registered apprentices.

The program aligns with Michigan Governor Gretchen Whitmer’s “60 by 30” initiative, which targets increasing the credentials among Michigan’s working-age adults to 60% by 2030.

Businesses interested in applying for the FY25 Cycle of the Going PRO Talent Fund can reach out to the Business Services team at Michigan Works! West Central via their website at www.mwwc.org/GoingPRO.

For more details or assistance with applications, local businesses in different counties can contact their respective representatives at Michigan Works! West Central.

This article, "Michigan Businesses Encouraged to Apply for Employee Training Grant Fund" was first published on Small Business Trends

]]>This initiative offers up to $5,000 in funding, business coaching, and technical assistance to help business owners overcome growth challenges, according to Corridor Business Journal.

To qualify for the program, businesses must be based in Iowa City and meet several criteria. They should operate for profit, have annual gross revenues under $4 million (averaged over the last three years), and be at least 51% owned and managed by women, minorities, service-disabled veterans, or individuals with disabilities.

Applicants who are not yet certified as a Targeted Small Business (TSB) will need to obtain this certification by the grant’s end. This effort is part of Iowa City’s commitment to inclusive economic development and aligns with the City Council’s goal to bolster home-grown businesses through enhanced technical support.

The application process is currently open, with a deadline set for 3 p.m. on Wednesday, November 6, 2024.

Applications can be submitted online at www.icgov.org/TSB.

This article, "Iowa City Launches Grant Program to Boost Local Small Businesses" was first published on Small Business Trends

]]>With up to $370,000 available in total funding, grant amounts range from $10,000 to $25,000 for pilot projects serving a specific region of Vermont, and $25,000 to $75,000 for projects operating statewide. No matching funds are required, and the grant period will run from March 2025 to June 2026.

Eligibility

This grant is open to two categories of applicants:

- Service Providers – Organizations that deliver business support services to Vermont’s agricultural and forestry businesses, such as market development, business planning, and financial planning.

- Producer Associations – Industry trade groups representing and promoting Vermont-based agricultural, food, beverage, forestry, or fiber products. These associations can apply for grants aimed at improving their organizational operations or delivering services to their members.

Eligible projects for service providers include offering assistance in areas such as market development, responses to crises like COVID-19 and flooding, business succession planning, and workforce development. Producer association projects may also focus on association development, including leadership training, board governance, and membership outreach.

Applicants must be Vermont-based or proposing a project fully focused on Vermont’s working landscape and businesses. For out-of-state applicants, eligibility should be confirmed with the program contact.

Key Dates and Deadlines

- September 20, 2024: Request for Applications released and application submission opens.

- September 24, 2024 (11 a.m. – 12 p.m.): Applicant webinar and Q&A session. Registration required.

- November 7, 2024 (11:59 p.m.): Application deadline.

- Early January 2025: Applicants notified of funding decisions.

- January 2025: Grantee documentation due.

- February/March 2025: Project start date.

For further information, applicants can contact Clare Salerno at [email protected] or (802) 917-2637.

This article, "Service Provider & Producer Association Grants Now Available for Vermont Businesses" was first published on Small Business Trends

]]>Administrator Isabel Casillas Guzman, who leads the SBA and serves as the voice for over 34 million small businesses in President Biden’s Cabinet, highlighted the importance of expanding the VBOC network. “The expansion of SBA’s network of Veterans Business Outreach Centers has been a top priority of the Biden-Harris Administration as we work to ensure our military-connected entrepreneurs have better access to SBA’s resources to pursue their entrepreneurial dreams following their service to our nation,” said Administrator Guzman. “With these new grants, veterans, service members, and military families in Ohio, Pennsylvania, and Puerto Rico will have local, trusted institutions ready to help them start and grow their businesses – strengthening their communities and our economy.”

Expansion of VBOC Program

This announcement marks a significant expansion of the SBA’s VBOC program, which will now grow from 28 to 31 locations. The VBOCs will serve all 50 states, the District of Columbia, Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, and American Samoa. The grants awarded to these organizations reflect their commitment to supporting veteran entrepreneurs and their ability to address the unique challenges faced by veterans and military families.

Robert Yannuzzi, Assistant Administrator for the SBA’s Office of Veterans Business Development, emphasized the impact of this expansion. “Thanks to this additional funding, we can increase our Veterans Business Outreach Centers and significantly support thousands of transitioning service members, National Guard and Reserve members, and their spouses in starting and growing their businesses,” Yannuzzi said. “VBOCs supported more than 53,000 clients in fiscal year 2023, and this expansion will help grow that number year over year.”

Services Provided by VBOCs

The new VBOCs will provide a wide range of services to veteran entrepreneurs, including:

- Business Planning: Offering training and counseling on accounting, financial planning, and management to help veterans develop strong business plans.

- Assistance Accessing Capital: Helping veterans understand and access available capital, including financing, loans, and grants.

- Government Contracting Guidance: Providing training on veteran business certification and best practices for securing government contracts.

- Marketing and Outreach: Assisting veteran-owned businesses with marketing and outreach to promote their services within their communities and beyond.

- Transitioning: Offering the Boots to Business program to help active-duty service members transition out of the military and into entrepreneurship.

Grant Awardees

The organizations receiving VBOC grants from the SBA are:

- Economic and Community Development Institute, Inc. (ECDI) – Columbus, Ohio

- Coverage Area: Ohio

- Pennsylvania State University – University Park, Pennsylvania

- Coverage Area: Pennsylvania

- Corporación para el Financiamiento Empresarial del Comercio y de las Comunidades (COFECC) – San Juan, Puerto Rico

- Coverage Area: Puerto Rico and the U.S. Virgin Islands

These organizations will play a crucial role in supporting veteran entrepreneurs in their respective regions, helping them overcome obstacles and achieve success in their business endeavors.

For more information about the Veterans Business Outreach Centers and to find a VBOC near you, visit www.sba.gov/vboc. To learn more about SBA’s programs for veterans, visit www.sba.gov/veterans.

This article, "SBA Announces $1 Million in Grants to Expand Resources for Veteran Entrepreneurs" was first published on Small Business Trends

]]>Purpose and Impact

The Hazardous Fuels Transportation Assistance program is a critical component of the Forest Service’s 10-year Wildfire Risk Reduction Strategy. By providing financial support for the transportation of hazardous fuels to locations where they can be utilized for wood products and services, the program contributes to reducing wildfire risk and maintaining the health of national forests. The program also supports the forest products industry, which plays a vital role in forest restoration efforts.

Funding and Eligibility

The Forest Service anticipates awarding up to $25 million through this funding opportunity. Grants will be provided to diverse applicants, including manufacturing facilities, wood energy providers, logging contractors, and organizations supporting underserved communities. Eligible entities include for-profit and non-profit organizations, U.S. state and local governments, tribal entities, and educational institutions.

To qualify, projects must focus on the removal of hazardous fuels from National Forest System lands or demonstrate a clear benefit to these lands. Applications may include multiple contracts and agreements, with a maximum combined funding request of $5 million per applicant. A 50% match contribution is required for each project, and applicants must demonstrate that transportation costs are a limiting factor to project viability.

Application Process and Criteria

Applications must be submitted via email to the Forest Service at [email protected]. The application package should include a cover page, project narrative, detailed budget, financial statements, and other supporting documents. Proposals will be evaluated based on several criteria, including the treatment of priority hazardous fuels, volume transported, benefit to disadvantaged communities, cost-effectiveness, and readiness for implementation.

Public Webinars

To assist applicants, the Forest Service will host public webinars on August 16, August 21, and August 28, 2024. These webinars, held in partnership with the National Wild Turkey Federation, will provide guidance on the application process and offer opportunities for participants to ask questions. Advanced registration is required.

Background

This grant program is funded by the Inflation Reduction Act and is authorized under the Wood Innovations grant program of the Agricultural Improvement Act of 2018. The initiative aligns with the U.S. Department of Agriculture’s Wildfire Crisis Strategy, which was announced in January 2022 to address the increasing risk of wildfires and promote sustainable forest management.

For more information on the Hazardous Fuels Transportation Assistance grants and to access application details, visit the Forest Service’s official website or contact [email protected].

This article, "US Forest Service Announces Hazardous Fuels Transportation Assistance Grants to Support Wildfire Crisis Strategy" was first published on Small Business Trends

]]>