Small Business Statistics

According to small business statistics from the SBA, small businesses comprise 99.9% of US businesses and employ 47.1% of US employees. Below we have compiled essential small business statistics to help you make informed decisions.

Statistics by Subject

The Latest Small Business Statistics

Featured Small Business Studies

Fast Facts and FAQs

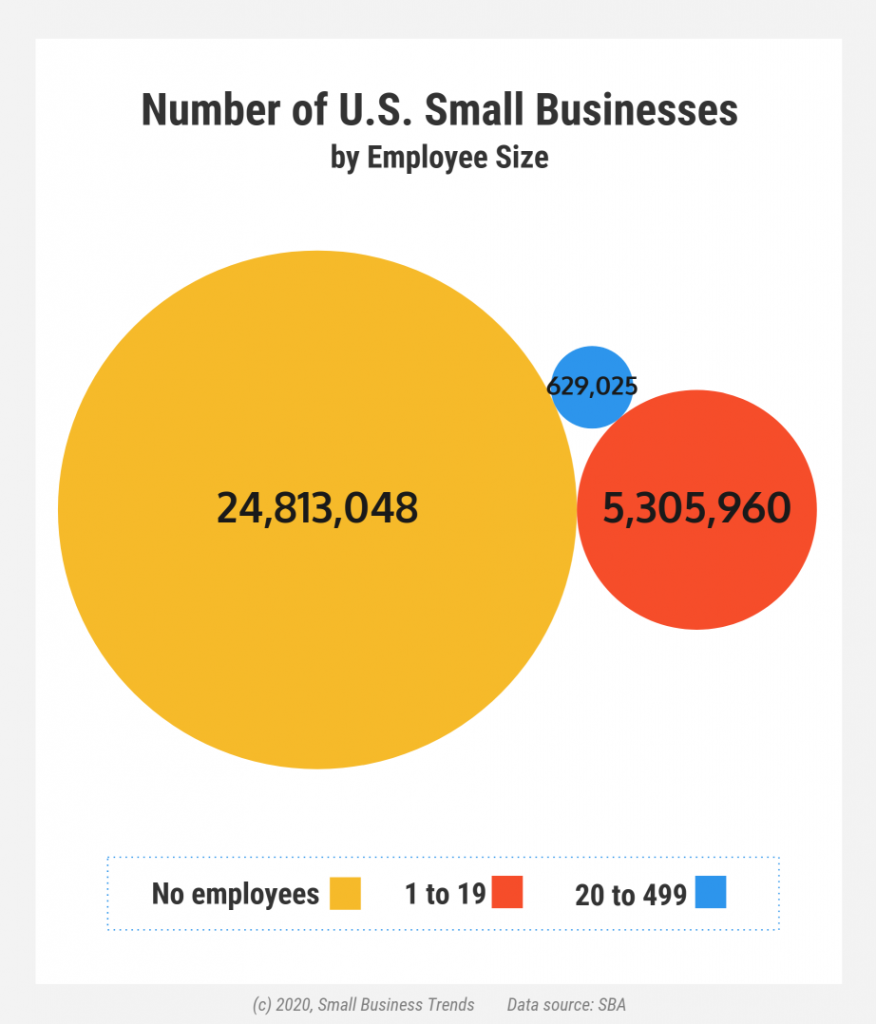

There are 31.7 million small businesses in the US. Out of which, 25.7 million small businesses have no staff member, and 6 million businesses employ paid workers.

Small businesses are establishments that employ less than 500 employees.

99.9% of all businesses are small businesses, in the US.

Small businesses are flourishing in America. If you check various small business statistics, you will learn small business owners works as the driving engine of the US economy.

Here are interesting statistics on what small businesses comprise:

- 47.1% of private-sector employees(61 million)

- 40.3% of private-sector payroll

By opening a small business firm, you will not only become your own boss but also become a member of a big thriving community.

There are 9.9 million women-owned businesses total when including women-owned firms without payroll, according to the SBA.

Women-owned firms are those business firms that are at least 51% owned, controlled, and operated by one or more female citizens of America. These firms play an active role in job creation – employing more than 9 million employees in the US.

The top industries by employment at companies owned by women are as follow:

- Healthcare and Social Assistance

- Accommodation and Food Services

- Administrative and Support

- Professional, Scientific, and Technical Services

- Retail Trade

On average, woman-owned companies have $1.3 million in annual sales and employ eight people. (SBA)

What is good about women-owned firms is that they are growing steadily. According to a study by Guidant Financial, 71% of companies owned by women are profitable.

So there is no surprise that a big share of women entrepreneurs are happy with what they are doing. 77% of women business owners have reported being happy, as per Guidant Financial research.

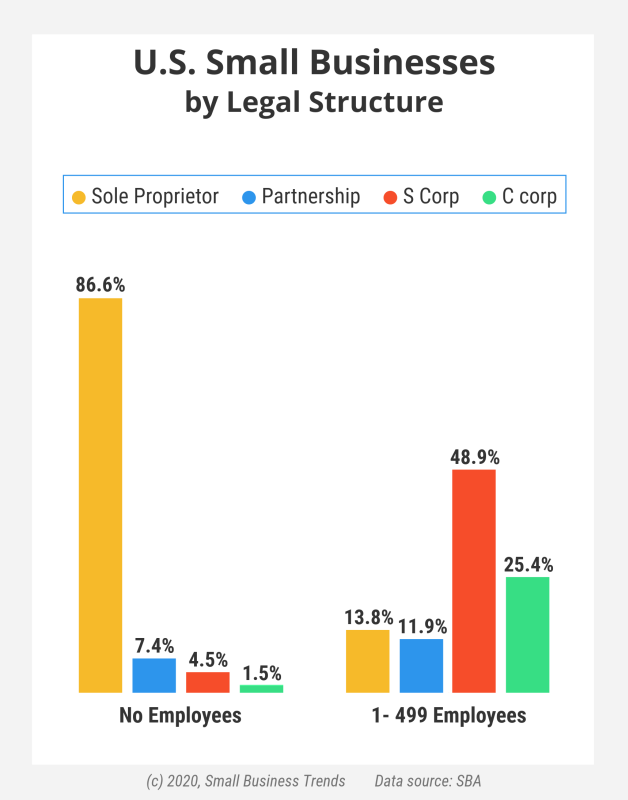

The growth rate of rural small businesses is 0.06%. However, establishments in the metropolitan counties have grown by 1.9% during the same time. (SBA)

[Image]

Rural or urban, challenges are an integral part of entrepreneurship. But rural small business owners sometimes face some additional obstacles like poor connectivity, non-availability of talents, poor access to funding, etc.

What’s more, small business support organizations, business mentors, small business mentors are prevalent in urban areas. These factors can affect growth.

So if you are going to open a business in a rural area, you should do your due diligence first. Then, prepare a business plan to tackle possible challenges you might face due to having your business in a rural area.

You should also note that having a business in a rural area is not all about facing additional challenges. A big share of business owners in rural areas reports having a good life despite the many challenges they face.

80% of rural entrepreneurs say they are better off than their urban counterparts, according to research done by a private sector company.

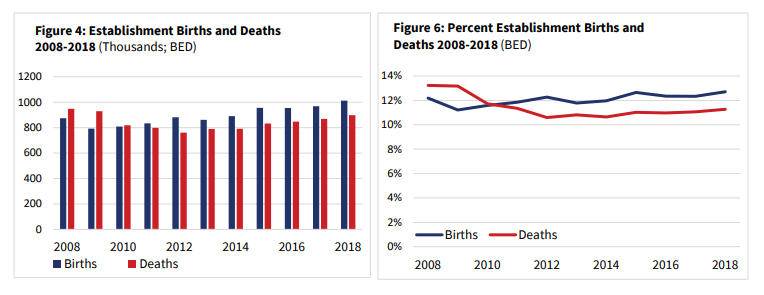

Small businesses employ 60.6 million people, which makes 47.1 percent of the U.S. private workforce, on a percentage basis.

Note; the private workforce excludes government workers. (SBA)

The average number of employees in a small business is about 10. This is the average for business firms that have at least one employee.

Out of the small businesses in the US that have staff members, here are statistics on the breakdown by size:

- 5,339,918 small businesses have 1 to 19 employees

- 5,976,761 small businesses have 20 to 499 employees

25.7 million small businesses in the US have no employees. The government calls these businesses “nonemployer businesses.”

[Image]

Here are statistics on the top 12 industries with the most small businesses:

- Other Services (4,435,573)

- Professional, Scientific and Technical Services (4,343,003)

- Construction (3,194,482)

- Real Estate, Rental, and Leasing (3,092,859)

- Retail Trade (2,739,144)

- Health Care and Social Assistance (2,591,786)

- Administrative, Support and Waste Management (2,487,228)

- Transportation and Warehousing (2,388,336)

- Arts, Entertainment and Recreation (1,565,439)

- Finance and Insurance (968,853)

- Accommodation and Food Services (940,215)

- Educational Services (834,018)

(SBA)

The above industry breakdown accounts for approximately 93.4 percent of all small businesses in the United States. (The number of businesses per industry is in parentheses.)

The data and charts on this page are from the most recently available U.S. government statistics. Sources include the U.S. Census, the Small Business Administration, BLS, and other reputed establishments.

Small Business Statistics FAQs

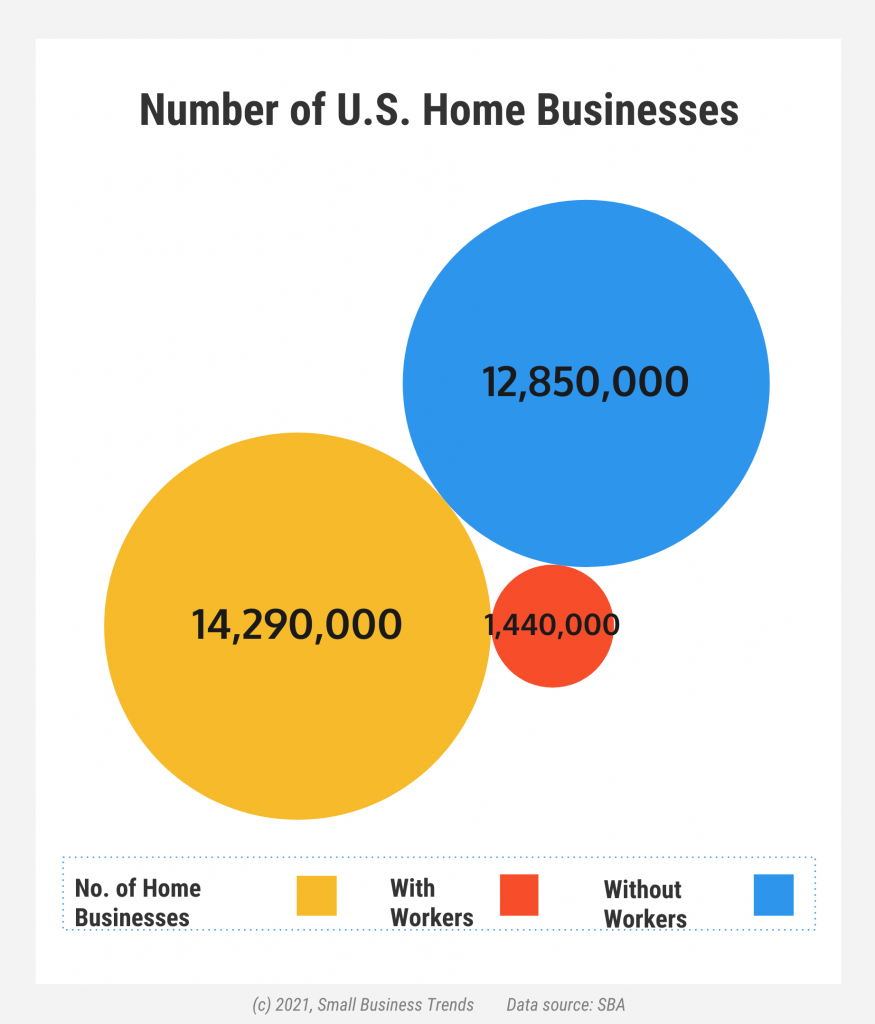

There are around 14.29 million home businesses in the US. Out of which, 1.44 million have paid workers, and the rest don’t have any staff members, according to the Small Business Administration.

Home businesses or home-based businesses are those that operate from home and don’t have a formal office. Six million firms have staff members in America. And a quarter (24%) of these firms are home-based.

It is quite understandable some industries where customers don’t frequently visit offices have more home-based firms.

So there is no surprise that 47% of construction firms and 45% of business service providers operate from home.

Needless to say, operating from home can significantly reduce operating costs for small business owners.

If your business model doesn’t require you to hire staff members, not renting an office can be a smart move to cut the cost. And you won’t be alone in doing so. Old data suggests that 50% of non-employers firms are home-based. (SBA)

According to the Bureau of Labor Statistics data, 25 million people do part-time jobs in the US. Some other common terms used for side business are side hustle, part-time hustle, second-job, and extra job.

Not all people do a side hustle to supplement their income to meet the rising cost of living. Only 7.6 million people do side hustle due to economic reasons. These people are often referred to as involuntary part-time workers.

Every business has a startup cost. And small business owners often use their own savings to start companies. Therefore, many do side hustle to save money to start their own companies later. (BLS)

The number of family-owned businesses (employers firms) in the US is 1.86 million.

As the name suggests, family-owned businesses are those where two or more family members control the decision making. There are 6 million employer firms in the US, and one in three employer firms (31%) are family-owned firms.

The number of family-owned firms is not even across industries. Some industries have the highest number of family-owned firms, while some have the lowest number of family-run firms.

Here are some important small business statistics on family-owned companies:

- Agriculture services have the largest number of family-owned firms (46%)

- Management of companies and enterprises consist of 46% of family-owned firms

- Health care and social assistance have the lowest number of family-owned firms (18%)

When it comes to employment, a family-owned company employs more people (per company) than a non-family owned firm.

On average, family-owned businesses have 14 employees per firm. However, non-family run firms have an average of 10 employees per firm. (SBA)

Entrepreneurs turn to personal and family savings to get the money to start a business. In fact, 64.4% of small business owners have used personal and family savings to take the plunge into the business world.

Even some business owners (9.1%) utilize family assets to get money for their entrepreneurial journey.

It is no brainer that getting a business loan is not easy when a company is in its initial stage. Only 16.5% of entrepreneurs take small business loans from banks or financial institutions to start their businesses.

So if you’re going to use your personal money to start a business, you will not be doing it along. Most of the small business owners get started this way only – relying on personal savings to start their company. (SBA)

The most common source of funding to start a business is personal and family savings (64.4% of small employer firms), followed by a business loan from a bank or financial institution (16.5%), personal credit cards (9.1%), and personal family assets other than savings of the owner (8.7%). (ASE)

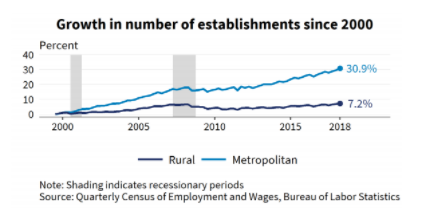

[Image]

As time increase, the failure rate also goes up for new businesses. Look at the following statistics to learn how the first few years can affect the survival rates of new companies:- 51.2% of new businesses failed during the first five years

- 66.4% of new businesses failed during the first ten years of being open

The biggest reason why small businesses fail is- no market need for products/services they offer. In fact, 42% of businesses fail because people no longer need products/services those businesses offer.

So you should always keep tabs on customers’ trends and reinvent your business accordingly.

Digging deeper into statistics on why companies fail, you will learn that there is rarely one reason for a single company’s failure.

Startup capital plays a critical role in any business’s survival, and cash flow problems can be fatal to any business. 29% of small business firms fail because they run out of cash. So it is imperative that you need to check cash flow statements regularly.

Here are some other statistics on why small business firms fail:

- 23% of small businesses don’t survive because they don’t have the right team

- 19% of small business don’t make it as they are outcompeted

- Pricing and cost issues kill 18% of small businesses

Unicorn startups, small businesses, or medium-size enterprises, poor marketing affects all. It has been found that poor marketing strategy contributes to 14% of small businesses’ failure. (CBInsights)

Number of Small Businesses - State Map

Small Business Statistics by State

| State | Number of Small Businesses | Percent of Businesses that are Small | Number of Small Business Employees | Percent of Workforce in Small Businesses |

|---|---|---|---|---|

| Alabama | 396,432 | 99.4% | 789,425 | 47.2% |

| Alaska | 73,354 | 99.1% | 141,147 | 53.0% |

| Arizona | 571,495 | 99.4% | 1,039,228 | 43.7% |

| Arkansas | 249,907 | 99.3% | 490,497 | 47.9% |

| California | 4,203,260 | 99.8% | 7,129,204 | 48.8% |

| Colorado | 630,113 | 99.5% | 1,117,202 | 48.2% |

| Connecticut | 346,950 | 99.3% | 750,457 | 48.9% |

| Delaware | 82,121 | 98.3% | 187,556 | 46.9% |

| District of Columbia | 76,083 | 98.2% | 247,461 | 47.0% |

| Florida | 2,494,279 | 99.8% | 3,397,931 | 41.6% |

| Georgia | 1,051,071 | 99.6% | 1,637,892 | 43.1% |

| Hawaii | 132,640 | 99.3% | 275,115 | 52.1% |

| Idaho | 162,905 | 99.2% | 315,753 | 56.2% |

| Illinois | 1,233,572 | 99.6% | 2,485,857 | 45.1% |

| Indiana | 512,348 | 99.4% | 1,222,372 | 44.9% |

| Iowa | 270,484 | 99.3% | 651,635 | 48.1% |

| Kansas | 254,297 | 99.1% | 604,215 | 51.0% |

| Kentucky | 351,260 | 99.3% | 702,054 | 43.8% |

| Louisiana | 447,440 | 99.5% | 902,758 | 52.8% |

| Maine | 147,270 | 99.2% | 289,156 | 56.5% |

| Maryland | 594,124 | 99.5% | 1,143,191 | 50.1% |

| Massachusetts | 669,224 | 99.5% | 1,490,416 | 45.8% |

| Michigan | 873,722 | 99.6% | 1,868,885 | 49.1% |

| Minnesota | 520,110 | 99.5% | 1,254,958 | 47.2% |

| Mississippi | 257,404 | 99.3% | 440,399 | 46.9% |

| Missouri | 532,277 | 99.4% | 1,168,725 | 46.8% |

| Montana | 120,246 | 99.3% | 245,411 | 64.8% |

| Nebraska | 176,358 | 99.1% | 412,291 | 46.6% |

| Nevada | 270,079 | 99.2% | 487,407 | 41.8% |

| New Hampshire | 134,760 | 99.0% | 295,895 | 49.8% |

| New Jersey | 884,049 | 99.6% | 1,810,107 | 49.8% |

| New Mexico | 154,804 | 99.0% | 334,945 | 53.3% |

| New York | 2,168,799 | 99.8% | 4,106,086 | 50.2% |

| North Carolina | 913,398 | 99.6% | 1,672,050 | 44.1% |

| North Dakota | 73,142 | 98.8% | 198,964 | 57.3% |

| Ohio | 949,479 | 99.6% | 2,192,920 | 45.8% |

| Oklahoma | 350,718 | 99.4% | 712,582 | 52.4% |

| Oregon | 377,860 | 99.4% | 852,983 | 55.0% |

| Pennsylvania | 1,058,033 | 99.6% | 2,497,524 | 46.6% |

| Rhode Island | 101,516 | 98.9% | 229,974 | 52.8% |

| South Carolina | 418,031 | 99.4% | 794,711 | 46.3% |

| South Dakota | 86,550 | 99.0% | 210,534 | 58.8% |

| Tennessee | 603,310 | 99.4% | 1,096,245 | 42.3% |

| Texas | 2,679,964 | 99.8% | 4,706,864 | 45.1% |

| Utah | 287,803 | 99.3% | 572,888 | 46.2% |

| Vermont | 77,614 | 99.0% | 161,080 | 61.3% |

| Virginia | 745,886 | 99.5% | 1,535,136 | 47.2% |

| Washington | 608,956 | 99.5% | 1,379,558 | 51.4% |

| West Virginia | 113,410 | 98.9% | 275,145 | 49.2% |

| Wisconsin | 452,594 | 99.4% | 1,258,929 | 49.9% |

| Wyoming | 66,653 | 98.8% | 131,499 | 63.1% |

| Total USA | 30,748,033 | 99.9% | 59,915,217 | 47.3% |

Table Data Source: U.S. Census Bureau. Figures released by the Small Business Administration Office of Advocacy, “Small Business Profiles”. Table does not include territories such as Puerto Rico or Guam. Percent of workforce in small businesses is based on the number of people employed in the private (nongovernmental) workforce. Percentages are rounded.

Small Business Demographics

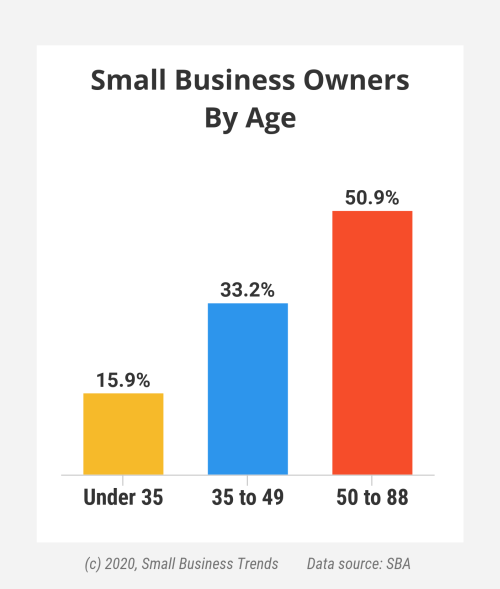

Almost 51% of small business owners are 50 years old or older. The breakdown is as follows:

- Under 35 years – 15.9%

- Age 35 to 49 – 33.2%

- Age 50 to 88 – 50.9%

Most people think of entrepreneurs as young, and for startups that tend to be true. However, successful small businesses have been around for years. The owner of these established small businesses ages along with the business.

There are 379,620 veteran-owned employer businesses in the United States. Veteran-owned businesses are those that are owned, operated, and controlled by veterans. (SBA)

Following are some important small business stats on how veteran-owned businesses contribute to the US economy:

- Veteran-owned business firms have 4.2 million people on the payroll

- Businesses owned by veterans amass $901 billion in total annual receipts

When it comes to employing the number of average people per firm, veteran-owned firms employ on average 11 people. Read more, including which industries and states they are in Veteran Owned Business Statistics.

Small Business Financial Profile

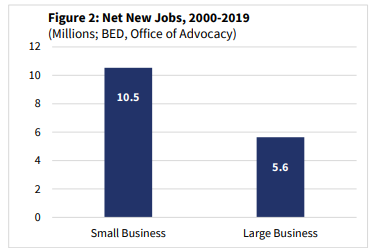

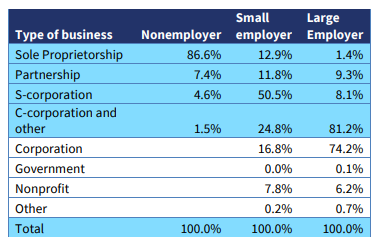

23.04 million small business owners are sole proprietors. And about 4.21 million small business owners are S corps. Partnerships and C corporations make up the rest. See the accompanying chart.

[Image]

The numbers break down according to business size:

- Among firms without employees, the majority of small businesses are sole proprietors (86.6%). A small business that has no employees tends to be much smaller in revenue size, too.

- Once a business gets large enough to have employees or its finances get more complex, the business is more likely to file an S corp election with the IRS. Nearly half of all businesses large enough to have employees choose S-corp status.

In practice, most business owners start out as sole proprietors, perhaps using a single-member LLC (still considered a sole proprietor by the IRS for tax purposes). But as the business grows, the owner may find it advantageous tax-wise to become an employee of his or her own company and file an S-corp election to save on FICA taxes.

The median income for small business owners is:

- $51,816 for owners in incorporated businesses

- $26,084 for owners in unincorporated businesses

Median income means that half of small business owners’ earnings are above the number, and half are below.

Source of the above: American Community Survey, U.S. Census, 2017.

A different set of figures comes from private firm Payscale. Its research shows that the average small business owner makes $70, 220 a year. The range is $31,000 to $159,000 annually.